In the ever-evolving landscape of finance and technology, cryptocurrencies have emerged as a revolutionary force, challenging traditional financial systems. Among the pioneers in this space is Coinbase, a leading cryptocurrency exchange that has played a crucial role in bringing digital assets into mainstream consciousness. In this article, we will explore the prospects of investing in Coinbase stock, delving into its history, recent developments, and the broader context of the cryptocurrency market.

Understanding Coinbase and its Significance

Founded in 2012 by Brian Armstrong and Fred Ehrsam, Coinbase has grown from a startup to a global powerhouse in the cryptocurrency space. The platform serves as a bridge between the traditional financial world and the rapidly expanding realm of digital assets. As of my last knowledge update in January 2022, Coinbase has become a household name, providing a user-friendly interface for buying, selling, and storing various cryptocurrencies, including Bitcoin, Ethereum, and many others.

Coinbase Stock Performance

A Historical Perspective

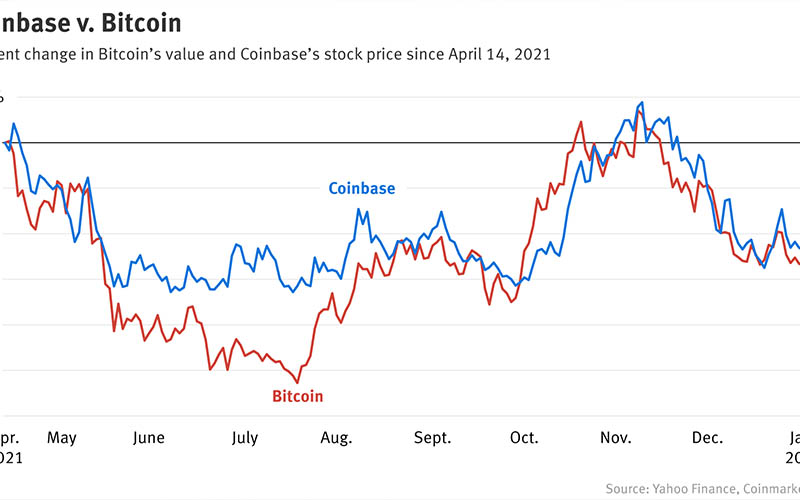

One of the primary considerations for any potential investor is the historical performance of the stock. Coinbase Global, Inc. (COIN) went public through a direct listing on the Nasdaq in April 2021. The listing marked a significant milestone for the cryptocurrency industry, as Coinbase became the first major crypto-focused company to be publicly traded in the United States.

The initial trading days were marked by high volatility, reflecting the speculative nature of the cryptocurrency market. However, Coinbase’s stock price stabilized over time, offering investors a glimpse of its potential as a long-term investment. It’s essential to note that cryptocurrency-related stocks can be subject to fluctuations driven by market sentiment, regulatory developments, and overall industry trends.

Key Factors Influencing Coinbase Stock

Cryptocurrency Market Trends

The performance of Coinbase stock is intricately tied to the broader trends in the cryptocurrency market. As the adoption of digital assets continues to grow, Coinbase is well-positioned to benefit from increased trading volumes and user activity on its platform.

Regulatory Environment

The regulatory landscape for cryptocurrencies is constantly evolving. Investors in Coinbase stock should closely monitor regulatory developments, as changes in regulations can impact the company’s operations and market dynamics.

Innovation and Expansion

Coinbase’s ability to innovate and expand its offerings is crucial for sustained growth. The company has introduced new features and services, such as Coinbase Pro for advanced traders and Coinbase Earn for educational purposes. Continued efforts in this direction can enhance Coinbase’s competitive edge.

Market Sentiment

Cryptocurrency markets are known for their sensitivity to market sentiment. Positive developments in the crypto space, such as widespread adoption by institutional investors or advancements in blockchain technology, can positively influence Coinbase stock.

Recent Developments

Since the initial public offering (IPO), Coinbase has been actively expanding its services and strengthening its position in the market. Some notable developments include:

Partnerships and Collaborations

Coinbase has entered into strategic partnerships with various financial institutions and businesses, aiming to broaden its reach and offer more seamless integration with traditional finance.

Introduction of New Cryptocurrencies

Coinbase regularly adds support for new cryptocurrencies, providing users with access to a diverse range of digital assets. The inclusion of popular and emerging cryptocurrencies can attract more users to the platform.

Educational Initiatives

Recognizing the importance of educating users about cryptocurrency, Coinbase has invested in educational initiatives. Coinbase Earn, for example, allows users to earn cryptocurrency while learning about different projects.

Investing in Coinbase Stock

A Strategic Approach

Investing in Coinbase stock requires a strategic approach, considering the unique characteristics of the cryptocurrency market. Here are some key points to consider:

Diversification

As with any investment, diversification is a fundamental strategy to manage risk. While Coinbase may be a promising investment, it’s essential to have a well-balanced portfolio that includes a variety of assets.

Long-Term Perspective

Given the volatility of the cryptocurrency market, investors in Coinbase stock should adopt a long-term perspective. This approach can help navigate short-term fluctuations and capitalize on the potential growth of the digital asset industry.

Stay Informed

Cryptocurrency markets are dynamic, and staying informed about market trends, regulatory changes, and technological advancements is crucial. Regularly monitoring Coinbase’s announcements and industry news can provide valuable insights for investors.

Risk Management

Cryptocurrency investments come with inherent risks. Investors should carefully assess their risk tolerance and allocate capital accordingly. Implementing risk management strategies, such as setting stop-loss orders, can help mitigate potential losses.

Conclusion

As the cryptocurrency market continues to evolve, Coinbase stands as a key player facilitating the adoption of digital assets on a global scale. Investing in Coinbase stock offers exposure to the growth potential of the cryptocurrency industry, but it’s essential to approach it with a well-informed and strategic mindset. By considering the historical performance, recent developments, and key influencing factors, investors can make informed decisions regarding Coinbase stock as they navigate the exciting and dynamic world of cryptocurrency investments.